Wealth planning requires vulnerability — that’s why trust is so important to us. We

look at everything from your income streams to your insurance policies. This

“everything on the table” approach allows us to confidently see your financial

position so we can give you the best advice possible.

Once we have established a clear starting point, we build a

road map of possible alternatives for your portfolio — allowing you the power

to choose the course of action that best satisfies your goals.

Our Approach

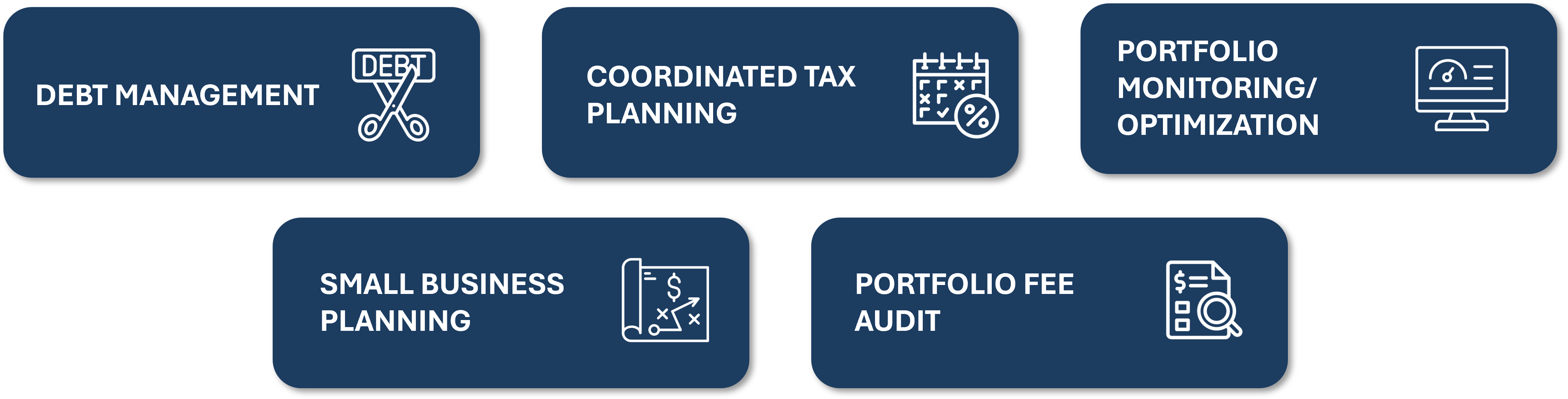

We use the following techniques to develop a sound and holistic approach to reaching your financial goals:

Part of our philosophy includes meeting each of our clients

face to face before getting started. If we don’t think we are the right fit for

what you need, we’ll be honest. We do this because we believe you deserve the

best advice possible — regardless of where it comes from.

Other financial products we can help with:

- Mutual Funds and Segregated Funds – Used to build diversified portfolios tailored to your risk tolerance and long term objectives.

- High Interest Savings accounts for personal or Business Banking – Ideal for short-term savings and emergency funds, offering competitive rates with no fees.

- GIC’s and Annuities – Provide stability and guaranteed income, especially useful in retirement or conservative strategies.

- RESP’s – Help you save for your children's education while taking advantage of governments grants.

- TFSA – Flexible, tax-free growth for a variety of savings goals, from travel to home renovations.

- RDSP – Support long-term financial security for individuals with disabilities, with valuable government contributions.

- Cash Flow Investments – Designed to generate reliable, tax-efficient income from both registered and non-registered accounts.